Trump Reshapes Obesity Drug Prices, Novo Tops Pfizer Again — This Week in Biotech #77

Politics, pricing, and pipelines collide. From GLP-1 wars and TrumpRx to Moderna’s refocus and J&J’s Caplyta win (Oct 31-Nov 6, 2025).

Hi and welcome to This Week in Biotech by Biotech Blueprint, edition 77, covering biotech & pharma news from October 31st through November 6th, 2025.

🌐 Visit our updated website biotechblueprintconsulting.com for more content.

🎙️ Biotech Blueprint brings you weekly video updates on the latest biotech and pharma news, plus in-depth podcast interviews with industry leaders. You can find us on YouTube, Spotify, and Apple Podcasts.

In the latest episode, we discuss mRNA vaccines for latent viruses (CMV, EBV, HSV) and cancer, where antibodies aren’t enough and T cell training is essential. You can read the accompanying article below.

THIS WEEK IN BIOTECH VIDEO SUMMARY

THIS WEEK’S KEY TAKEAWAYS 🔑

Pfizer’s courtroom effort to block Novo Nordisk’s Metsera takeover flopped earlier this week. Novo fired back with another bid hike, topping Pfizer’s freshly matched $10B offer. The auction now tilts Novo’s way. Metsera’s board reaffirmed Novo’s “superior proposal,” restarting Pfizer’s two business day match window ahead of a Nov 13 shareholder vote. Pfizer must now match or beat Novo’s newest bid or risk losing its best GLP-1 entry point. Regulatory scrutiny (FTC/HSR) still looms, but for now the fight over Metsera is biotech’s Super Bowl: Pfizer’s last shot at a GLP-1 foothold vs. Novo’s push to solidify dominance in the $150B market.

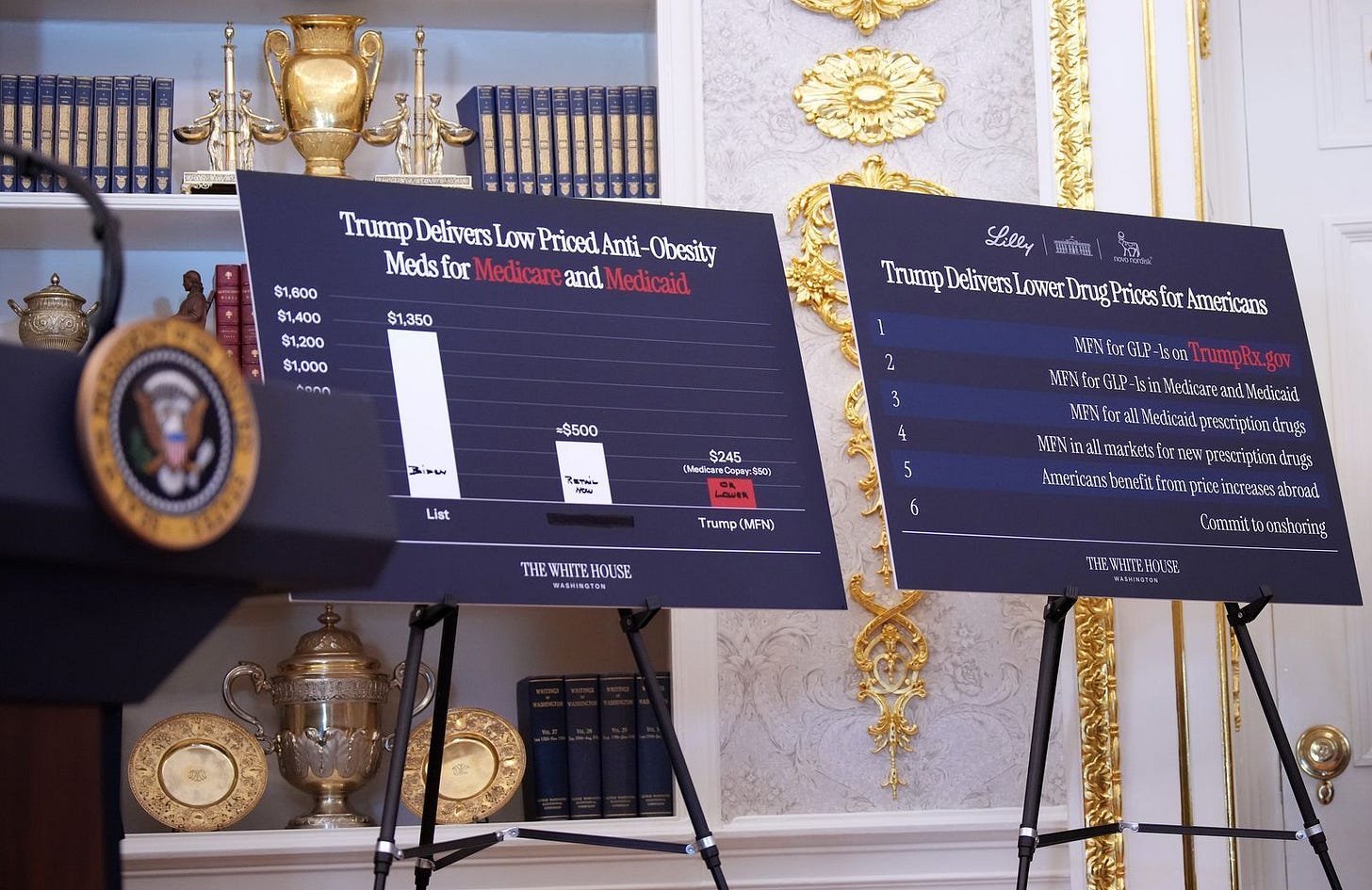

Meanwhile, President Trump cut a pricing deal with Lilly and Novo that could redefine obesity drug economics. Under the new TrumpRx platform, GLP-1 injectables like Ozempic and Mounjaro will run $245 a month, and oral versions $149 with Medicare copays capped at $50. It’s part coverage expansion, part manufacturing play, part political flex that could pull GLP-1 prices down significantly.

Moderna delivered a better than feared quarter: Revenue hit $1B, topping estimates, as the company slashed $700M in operating costs and narrowed its full year outlook. With Covid shot demand fading and RSV sales barely registering, Moderna cut CMV and is doubling down on flu, combo flu/COVID, cancer, and rare disease.

Depression treatment just got its most practical upgrade in years. J&J’s Caplyta can be added to standard antidepressants, showing early and sustained efficacy with placebo-like tolerability. It’s the kind of drug psychiatrists reach for. With no titration and no metabolic baggage, it could shift expectations in a field long dominated by incremental selective serotonin reuptake inhibitors.

Meanwhile, Biohaven’s Vyglxia was rejected outright for spinocerebellar ataxia, with regulators dismissing its external control data as too biased, wiping 40% off the stock and likely ending that program. The same week, uniQure cratered over 55% after FDA backpedaled on its prior openness to Huntington’s gene therapy data. Together, they underscore the agency’s colder stance toward real world or single arm evidence, especially after recent accelerated approval scrutiny.

Sarepta, though, got a lifeline. Despite missing a key endpoint for its exon-skipping drugs, the company rallied after strong Elevidys sales ($132M vs. $50-100M expected) and an analyst upgrade. It’s a reminder that commercial traction still trumps trial drama when the narrative and insurance coverage hold steady.

And finally, Viking Therapeutics stole a page from the GLP-1 playbook with VK2735, showing it can not only drive double digit weight loss but also normalize blood sugar and reverse metabolic syndrome in most treated patients. If that holds up in phase 3and they execute on manufacturing/commercial, Viking could emerge as a leading fast follower behind Lilly and Novo.

BIOTECH/PHARMA NEWS 🧬

🔹 A Delaware judge denied Pfizer’s bid to temporarily block Metsera from terminating its merger and pivoting to Novo Nordisk’s $10B offer, clearing the way for Novo’s $86.20/share proposal. Pfizer argued Novo’s structure is meant to “stall, not close” and entrench GLP-1 dominance. Judge Morgan Zurn said the claims didn’t justify a delay. Separately, the FTC warned that Novo’s current structure may violate Hart-Scott-Rodino procedural requirements if completed without a pre-merger filing, while Novo says it’s cooperating and compliant. The ruling follows days of escalation: Pfizer filed two lawsuits (antitrust + contract) and both sides raised bids (Pfizer has now matched $10B, and Novo immediately topped it again. Novo’s CEO said “our bid is higher” and openly challenged Pfizer to raise its offer). Metsera’s board again deemed Novo’s offer “superior,” restarting a fresh two day match window for Pfizer. A shareholder vote is scheduled for Nov. 13. The loss in court is a major setback to Pfizer’s push to enter the $150B GLP-1 obesity market through Metsera’s next-gen injectables and oral obesity candidate (MET-224o). Metsera’s stock is up 28% in the past five days.

🔹 President Trump announced new pricing deals with Eli Lilly and Novo Nordisk, marking the administration’s most significant move yet under its “Most Favored Nation” drug pricing policy. Starting early 2026, injectable GLP-1 drugs (Ozempic, Wegovy, Mounjaro, Zepbound) will be offered through Medicare, Medicaid, and the new TrumpRx platform at a starting price of $245/month, down from current list prices of $1,000-$1,350. Oral GLP-1s, including obesity-specific pills like Wegovy oral, but not Rybelsus, will launch at $149/month. Medicare beneficiaries will pay a $50 copay. The administration claims the new pricing will make obesity drug coverage possible for the first time for patients with obesity or metabolic risk, while saving taxpayers versus Biden-era proposals. Both companies also pledged major U.S. manufacturing expansions (Novo committing $10B and Lilly $27B) as part of the deal. The agreement represents a major policy and market shift, expanding public coverage of GLP-1s and potentially pressuring competitors and commercial pricing across the weight-loss drug market.

🔹 Moderna (MRNA) reported Q3 revenue of $1.0B and a $200M loss ($0.51/sh), outperforming expectations thanks to stronger Covid vaccine sales ($971M) despite weak RSV uptake ($2M). The company cut 2025 operating expenses by $700M to $5.2-$5.4B, raised cash guidance to $6.5-$7B, and narrowed 2025 revenue to $1.6-$2.0B as U.S. vaccination rates fell after tighter FDA and CDC guidance. Efficiency gains and scaled-back R&D helped offset lower demand, with Moderna ending several early-stage programs to focus on near-term products. The pipeline now centers on its flu vaccine (filings by Jan 2026), flu/COVID combo (awaiting FDA feedback), cancer vaccines with Merck, and rare disease therapies, while the CMV program was discontinued after a failed phase 3 trial.

🔹 FDA approved J&J’s Caplyta (lumateperone) as an add-on therapy for adults with major depressive disorder (MDD), expanding its use beyond schizophrenia and bipolar depression. In two phase 3 studies, patients taking Caplyta alongside an antidepressant showed significantly greater improvement in depression scores compared to those on antidepressant + placebo. Benefits appeared within the first couple of weeks and continued through six weeks. The drug’s safety profile was similar to placebo with minimal weight or metabolic changes and low rates of movement or sexual side effects. In a six month follow up, 80% of patients responded and 65% reached remission. Caplyta, taken once daily with no need for dose adjustment, offers a new, well-tolerated option for people who still have depressive symptoms despite standard treatment.

🔹 Biohaven (BHVN) collapsed 40% after the FDA rejected its lead drug Vyglxia (troriluzole) for spinocerebellar ataxia, issuing a Complete Response Letter that flagged “bias and design limitations” in the company’s real-world and external control studies. The decision surprised investors after the therapy showed >50% slowing of disease progression in a 3 year study and had been under priority review with no advisory meeting held. CEO Vlad Coric blasted the FDA for a lack of flexibility on rare-disease evidence, while Bank of America downgraded the stock (from Buy to Neutral, PT $49 → $10), saying “no viable path to market” is visible without new trial data. Biohaven said it will meet with the FDA to discuss next steps and is launching a restructuring to cut R&D spend by 60%, refocusing on its IgA nephropathy, epilepsy, and obesity pipelines.

🔹 Incyte (INCY) struck an exclusive option deal with Prelude Therapeutics (PRLD) for its mutant-selective JAK2V617F JH2 inhibitor, aimed at treating myeloproliferative neoplasms - rare blood cancers driven by JAK2 mutations. The deal could be worth up to $935M, including $35M upfront, a $25M equity investment, $100M if Incyte exercises its option, and up to $775M in milestones plus royalties. Prelude’s stock initially fell 48% as it announced a strategic refocus: pausing its SMARCA2 degrader cancer program, prioritizing its KAT6A degrader for ER+ breast cancer, and extending its cash runway into 2027-2028. Prelude will present preclinical JAK2V617F data at ASH 2025.

🔹 After plunging 25% earlier this week on a failed confirmatory trial for its exon-skipping drugs Amondys 45 and Vyondys 53, Sarepta (SRPT) rebounded +15% Wednesday as Mizuho upgraded the stock to Outperform and raised its target from $19 → $26. The bullish turn comes after Elevidys, Sarepta’s gene therapy for Duchenne muscular dystrophy, posted a standout $132M in Q3 sales (vs. $100M consensus), easing investor concerns over a recent commercial pause and safety-related setbacks. Mizuho cited strong insurer coverage, new prophylactic sirolimus protocols, and long-term pipeline potential, including RNA candidates SRP-1001/1003, as drivers of renewed confidence. Despite the exon-skipping miss, analysts expect those therapies to remain on the market given supportive real-world data and FDA precedent.

🔹 uniQure (QURE) plunged over 55% after the FDA signaled it may no longer accept data from the company’s phase 1/2 AMT-130 trial in Huntington’s disease as sufficient for approval. The gene therapy, which earlier earned Breakthrough Therapy and RMAT designations, had shown a 75% slowing of disease progression in small early studies using external controls. uniQure said the feedback marks a “drastic shift” from prior FDA guidance and leaves the BLA timeline uncertain, pending final meeting minutes expected within 30 days. Analysts called the move “confusing and unexpected,” given prior alignment, and speculated the FDA may want more mature or randomized data before considering a filing. The reversal stunned investors and the Huntington’s community, which had hailed AMT-130 as potentially “game changing.”

🔹 Alvotech’s U.S. launch plans hit another snag after the FDA issued a complete response letter for its biosimilar to Simponi (golimumab), citing lingering deficiencies at the company’s Reykjavik manufacturing site first flagged during a July inspection. No issues were raised with the drug itself, but the agency said the facility problems must be resolved before approval. Alvotech had already submitted a corrective action plan and said it expects to fix the outstanding concerns. The delay pushed shares down over 20% and forced a guidance cut. If cleared, AVT05 would become the first U.S. biosimilar to Simponi, a J&J anti-inflammatory drug with under $300M in U.S. sales in the first half of 2025.

🔹 George Tidmarsh, head of the FDA’s Center for Drug Evaluation and Research (CDER), was put on leave Oct. 31 and then resigned, per HHS, after a now-deleted LinkedIn post criticized Aurinia’s lupus nephritis drug Lupkynis (voclosporin) as “significantly toxic” and lacking hard clinical endpoints. His comments knocked the stock 20% intraday (about $350M in value) and prompted an HHS inspector-general probe. Aurinia has sued for defamation, alleging Tidmarsh abused his position and even sought a bribe in a long running feud with board chair Kevin Tang. Tidmarsh denies wrongdoing, calls the FDA a “toxic environment,” and says he was targeted for opposing a new National Priority Review Voucher scheme he argues lacks legal footing. The flap adds to a year of senior level churn at FDA/HHS.

CLINICAL TRIAL UPDATES 📊

🔹 Vera Therapeutics (VERA) reported positive phase 3 ORIGIN-3 data for atacicept in IgA nephropathy, presented at ASN Kidney Week 2025 and published in NEJM. At week 36, atacicept cut proteinuria 46% from baseline and 42% vs. placebo (p<0.0001), with consistent benefit across subgroups. Secondary markers improved meaningfully (Gd-IgA1 ↓68%; hematuria resolved in 81% with baseline hematuria). Safety looked comparable to placebo with fewer serious AEs on drug (0.5% vs 5%) and no deaths or immunosuppression signals. Vera plans a Q4’25 BLA via Accelerated Approval (potential 2026 PDUFA). The blinded trial continues to assess two year eGFR outcomes, with completion expected 2027.

🔹 Viking Therapeutics (VKTX) released new phase 2 data showing its dual GLP-1/GIP agonist VK2735 significantly improved markers of prediabetes and metabolic syndrome in the 13 week VENTURE obesity trial. 78% of patients with prediabetes reverted to normal glycemic status vs. 29% on placebo, while 68% of those with metabolic syndrome no longer met diagnostic criteria vs. 38% for placebo. The results, presented at ObesityWeek 2025, add to prior findings showing up to 14.7% mean weight loss and 88% of patients achieving ≥10% weight reduction over 13 weeks. VK2735 is being tested both as a weekly injection (now in phase 3) and as an oral pill (phase 2), with CEO Brian Lian noting the drug’s potential to “reverse metabolic risk and improve overall cardiometabolic health.”

Have a great rest of your week and thanks for reading Biotech Blueprint!

The M&A frenzy you covered makes me think smaller plays like Azitra might finaly get attention from bigger pharma. Their dermatology focused microbiome platform has been under the radar but the drugpricing reforms could actualy help them position for partnerships. Once these big dealmakers finish with the obesity market they'll need to diversfy their piplines.

Oh man you’re gonna love our next write up. Hint (it includes an ABVX angle NOBODY has caught yet) over 100% upside!. Subscribe so you don’t miss it!