Novo tops Pfizer’s obesity bid; FDA moves to speed biosimilar approvals; Moderna–Merck rumors build — This Week in Biotech #76

Plus Novartis bets $12B on RNA delivery; Intensity’s tumor injection therapy stuns with 400% stock surge, and BridgeBio cements rare-disease momentum (Oct 24-30, 2025).

Hi and welcome to This Week in Biotech by Biotech Blueprint, edition 76, covering biotech & pharma news from October 24th to 30th, 2025.

🌐 Visit our updated website biotechblueprintconsulting.com for more content.

🎙️ Biotech Blueprint brings you weekly video updates on the latest biotech and pharma news, plus in-depth podcast interviews with industry leaders. You can find us on YouTube, Spotify, and Apple Podcasts.

In the latest episode, we discuss mRNA vaccines for latent viruses (CMV, EBV, HSV) and cancer, where antibodies aren’t enough and T cell training is essential. You can read the accompanying article below.

THIS WEEK IN BIOTECH VIDEO SUMMARY

THIS WEEK’S KEY TAKEAWAYS 🔑

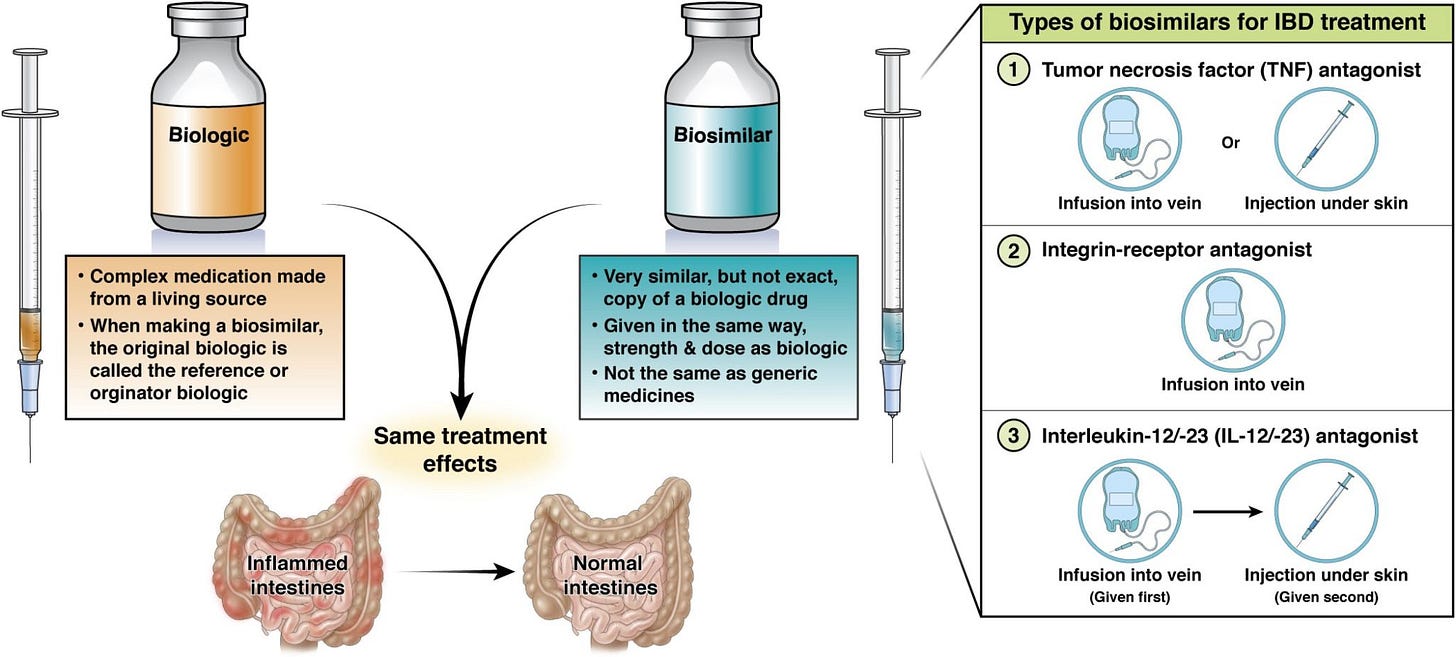

The FDA introduced major reforms to how biosimilars are approved. The agency will now allow companies to rely primarily on laboratory data instead of full human efficacy studies, which could cut development timelines in half and save around $100M per drug. The change is expected to increase competition in biologics (medicines that make up over half of U.S. drug spending but just 5% of prescriptions) while benefiting biosimilar makers like Amgen, Teva, Viatris, and Coherus at the expense of large biologic incumbents.

Novo Nordisk wedged into Pfizer’s obesity play, topping its Metsera bid with a $9B “superior offer.” The structure (cash now, contingent value rights later) is meant to lock up next-gen obesity programs and dosing options that could help Novo keep pace with Lilly’s Zepbound. Pfizer pushed back, saying the proposal evades antitrust rules and signaling it may sue.

In parallel, Moderna jumped 12% on a report it’s discussing a large transaction with at least one big pharma. Given Moderna’s 50/50 cancer vaccine tie up with Merck, investors speculated about Merck as a logical counterparty, but no talks have been confirmed.

And while rumors swirled, Novartis wrote an actual $12B check for Avidity Biosciences ahead of pivotal data. CEO Vas Narasimhan called it the “appropriate risk,” betting antibody-guided RNA drugs can finally crack muscle delivery. If 2026 readouts hit, Novartis could be first to scale a neuromuscular RNA franchise.

Intensity Therapeutics jumped 400% after eBioMedicine published early human data on INT230-6: direct tumor injections showed a 75% disease control rate across >20 cancer types, signs of systemic immune activation, and minimal serious toxicity.

Elsewhere, BridgeBio scored two late-stage wins in rare genetic diseases, Kyverna’s autoimmune CAR-T cleared an early efficacy bar in myasthenia gravis, and Intellia’s gene editing flagship hit a safety snag that shook the entire CRISPR complex.

BIOTECH/PHARMA NEWS 🧬

🔹 Moderna surged about 12% after a STAT report said the company has held talks with at least one big pharma about a “significant” transaction, ranging from a full buyout to a large-scale partnership, though details are fuzzy and Moderna isn’t commenting. It also quietly pulled out of a UBS healthcare conference, adding to speculation. Context: the mRNA pioneer is trying to pivot beyond fading COVID vaccine revenue, its shares are down 40% over 12 months, and its key non-vaccine asset (the cancer vaccine mRNA-4157) is already partnered with Merck. This is one reason some analysts see a broad partnership or unit-level deal as likelier than an outright takeover, which would still help curb cash burn and diversify the story.

🔹 Novo crashes Pfizer’s Metsera deal. Metsera’s board said Novo Nordisk’s offer ($56.50 in cash now plus up to $21.25 in CVRs (max $77.75/share so about $9B)) is a “superior proposal” to Pfizer’s $47.50 + $22.50 CVR bid. The structure gives Novo 50% non-voting shares at signing and a same day $56.50 cash dividend to holders, then CVRs and the rest post approval. Pfizer calls the bid “illusory,” says Metsera can’t trigger the four day match window, and warns of antitrust risk. Metsera shares jumped 23%+ on Oct 30, while Novo slipped about 2%. Novo is paying up to secure next-gen obesity assets and dosing flexibility, while Pfizer must decide whether to sweeten terms or fight in court.

🔹 U.S. FDA unveiled sweeping reforms to accelerate biosimilar approvals and drive down drug costs, marking one of the Trump administration’s most aggressive health policy moves yet. The agency’s new draft guidance would allow drugmakers to skip many human “comparative efficacy” studies, a long a bottleneck in biosimilar development, and instead rely on analytical testing to prove equivalence. The FDA also no longer generally recommends separate “switching” studies for interchangeability, further lowering barriers to market entry. Biologics, which account for just 5% of U.S. prescriptions but over half of all drug spending, remain the main source of pharma profit concentration. Biosimilars, by contrast, cost roughly half as much and saved the U.S. an estimated $20B last year, yet cover fewer than 10% of biologics losing exclusivity this decade. Officials said the reforms could cut biosimilar development timelines in half (potentially from eight years to four), and trim $100M from the average program. Tougher news for the biologic incumbents and better margins and faster scale for biosimilar shops like Amgen, Teva, Viatris, and Coherus under looser FDA guardrails.

🔹 Novartis is paying $12B in cash ($72/share, a 46% premium) for Avidity Biosciences to bolt a muscle-targeted RNA platform (AOCs™) and three late-stage neuromuscular programs (DM1, FSHD, DMD) onto its neuroscience engine, while spinning out Avidity’s early cardiology assets into a separate “SpinCo.” Markets blinked at the timing, but CEO Vas Narasimhan framed paying before pivotal readouts as the “appropriate risk.” Strategically, this is a bet that antibody-guided oligos can crack delivery to muscle and create durable, first-in-disease franchises. Tactically, it’s a bold, pre-data bet. Novartis is paying up early, accepting short-term market skepticism in exchange for the chance to own a potentially game-changing pipeline once 2026 trial results arrive. Avidity’s stock (RNA) surged about 43% on the news. Shares of RNA-delivery peers jumped on Monday. Dyne Therapeutics (DYN) was up about 45%, while PepGen (PEPG) climbed roughly 21% but has since gone down to $4.98/share.

.🔹 Eli Lilly is diving deeper into genetic medicines with its acquisition of Adverum Biotechnologies, a struggling ocular gene therapy developer whose lead program, Ixo-vec, aims to transform wet age-related macular degeneration (wAMD) care from chronic injections to a single treatment. The $1.5B deal comes with a $65M bridge loan to keep Adverum solvent through its phase 3 ARTEMIS trial. Ixo-vec delivers aflibercept via a single intravitreal injection, potentially replacing the monthly anti-VEGF shots that dominate the $27B global AMD market. While big pharma peers have been retreating from cell and gene therapy, Lilly’s move signals conviction that ophthalmic gene delivery can still yield blockbuster scale returns if safety, durability, and payer uptake align.

CLINICAL TRIAL UPDATES 📊

🔹 Intensity Therapeutics’ stock exploded nearly 400% after eBioMedicine published results from its phase 1/2 trial of INT230-6, a direct injection cancer therapy designed to kill tumors locally while awakening the immune system. In 64 heavily pretreated patients with more than 20 cancer types, the treatment achieved a 75% disease control rate and a median survival of 11.9 months, almost double what’s typical in such refractory settings. Patients who received higher volume dosing (>40% of total tumor burden) lived a median 18.7 months. Safety looked clean, with no dose-limiting toxicities. Mechanistically, the drug mixes cisplatin and vinblastine with a diffusion enhancer that keeps 95% of the active agents inside the tumor, triggering both local destruction and T cell activation. Intensity is already running a phase 3 sarcoma trial and exploring combinations with Merck’s Keytruda and Bristol Myers Squibb’s Yervoy.

🔹 Kyverna posted strong interim phase 2 data for its one time CD19 CAR-T, KYV-101, in generalized myasthenia gravis: all 6 treated patients showed meaningful improvement at 24 weeks on both key measures (MG-ADL -8.0 points and QMG -7.7), with some benefits starting by week 2 and two patients nearing symptom-free status. Safety looked manageable as only mild cytokine release syndrome, no neurotoxicity, and one reversible case of low white cells. The results beat what’s typically seen with current drugs and support the ongoing registrational phase 3 trial.

🔹 BridgeBio surged 25% over five days after notching back to back late stage wins in rare genetic diseases. The first came from FORTIFY, where BBP-418, an oral therapy for limb-girdle muscular dystrophy type 2I/R9, hit every primary and secondary endpoint. Patients showed restored muscle-cell glycosylation (α-DG ↑ 1.8×), an 82% drop in serum creatine kinase, and better movement and lung function, all with a clean safety profile. Days later, the company’s CALIBRATE trial delivered similarly decisive results for encaleret, an oral CaSR modulator that normalized calcium and parathyroid hormone in patients with autosomal dominant hypocalcemia type 1, marking the first targeted option for that disorder. With two phase 3 wins and NDA filings planned for 2026, BridgeBio is suddenly looking less like a single asset story and more like a maturing rare disease platform with commercial depth.

🔹 Akebia dropped 19% after announcing it would abandon plans to expand Vafseo (vadadustat) beyond dialysis-dependent patients with chronic kidney disease (CKD), following a Type C meeting where the FDA pushed for a much larger, longer, and costlier trial than proposed. The company said it will not launch the VALOR study and will instead focus on maintaining and growing its current dialysis market, where Vafseo, an oral HIF-prolyl hydroxylase inhibitor that boosts endogenous erythropoietin to treat anemia, was approved in 2024. Investors read the move as a reset toward capital preservation rather than growth.

🔹 Intellia halted dosing and screening in its phase 3 MAGNITUDE programs for transthyretin amyloidosis (ATTR-CM and ATTR-PN) after a patient developed Grade 4 liver enzyme elevations with hyperbilirubinemia roughly 3 weeks post-dose. The patient was hospitalized and is under treatment while the company works with regulators on next steps. The trials had enrolled >650 (MAGNITUDE) and 47 (MAGNITUDE-2) patients, with about 450 already dosed. Shares cratered about 45% on the news, with broader gene-editing names wobbling in sympathy. The clinical takeaway is clear: in vivo CRISPR remains potent but unforgiving on safety, and late stage scale up can surface idiosyncratic hepatotoxicity that smaller studies miss. The market takeaway is clearer still: until Intellia explains mechanism, de-risks monitoring/mitigation, and restarts enrollment, multiples will compress and capital will pivot to cleaner risk/reward in gene editing and adjacent modalities.

🔹 Arcturus’ inhaled mRNA therapy for cystic fibrosis, ARCT-032, showed early biological activity in its phase 2 study, but investors weren’t impressed. After 28 days of treatment, 4/6 CF patients who dont’t respond to CFTR modulators saw reductions in mucus plugs and volume on AI-analyzed CT scans, suggesting the drug is hitting its target. Yet lung function, measured by FEV₁, barely budged, up just 5% in exploratory analysis, within the bounds of natural variability. Safety looked fine, and a higher dose cohort (15 mg) is underway ahead of a 12 week trial starting next year. The market reaction was swift: Citi downgraded the stock to Neutral, cutting its target from $49 to $12, calling the data “unconvincing.” Stock is down nearly 50%.

Have a great rest of your week and thanks for reading Biotech Blueprint!

The FDA biosimilar reforms are a huge tailwind for Amgen's biosimilar business, especially when you consider they already have manufacturing scale and regulatory expertise. Cutting development timelines in half could accelerate their Avastin and Stelara biosimilar programs significantly. The real question is whether this accelerats enough new entrants to compress margins faster than Amgen can capture market share from the biologic incumbents.