Moderna Merck V940 Shows Five Year Melanoma Durability, Biopharma Deal Activity Picks Up – This Week in Biotech #86

KEYNOTE-942 durability, plus GSK’s $2.2B RAPT food allergy deal, BMS partners with Janux, Corcept's overall survival win, and Corvus posts Phase 1 eczema data (Jan 16-22, 2026).

Welcome back to This Week in Biotech by Biotech Blueprint, edition 86, covering biotech and pharma news from January 16th to 22nd, 2026.

🎙️ Biotech Blueprint brings you weekly video updates on the latest biotech and pharma news, plus in-depth podcast interviews with industry leaders. You can find us on YouTube, Spotify, and Apple Podcasts.

SPONSOR CONTENT BY ARCHES DATA

Arches Data provides expert data science, analytics, and data engineering services to transform your raw information into a competitive advantage.

Book a consultation HERE.

Visit our website: archesdata.com.

VIDEO SUMMARY

THIS WEEK’S KEY TAKEAWAYS 🔑

This week felt like the exhale after the JPMorgan Healthcare Conference, with fewer headlines than typical.

First, Moderna and Merck added real long term follow up to the personalized neoantigen mRNA vaccine story in melanoma. A five year follow up that still shows about a 49% reduction in the risk of recurrence or death is the kind of durability clinicians respect and investors will actually underwrite. Moderna entered 2026 under heavy skepticism and elevated short interest, and the stock is starting to catch momentum as management leans harder into oncology and cardiovascular programs while stepping back from funding new phase 3 vaccine studies in the current US policy climate.

On the deal side, GSK is making a clean product profile bet in food allergy. The wager is that ozureprubart can match the anti-IgE effect that Xolair (Genentech and Novartis) established, while stretching dosing to about once every 12 weeks. If that holds, it is a meaningful quality of life win for kids and parents, and a very classic acquisition logic (validated target, better dosing, bigger addressable market). In parallel, BMS’s Janux partnership is another sign that tumor activated T cell engagers still draw big pharma interest. The deal structure is also pretty standard for early oncology programs as Janux runs the preclinical work through the IND, BMS takes over once it is ready for the clinic, and most of the economics sit in milestones and royalties tied to success.

Finally, two clinical updates are worth flagging. Corcept said its Phase 3 ROSELLA study hit overall survival in platinum resistant ovarian cancer, with no biomarker requirement and no meaningful added safety burden versus chemotherapy alone, setting up a high visibility FDA decision in July. Corvus also put up notably strong phase 1 cohort 4 atopic dermatitis data for an oral agent in a placebo controlled cohort, with responses deepening through eight weeks and a clean early safety profile, which is exactly the kind of package that earns a serious phase 2 run.

BIOTECH/PHARMA NEWS 🧬

🔹 Bristol Myers Squibb signed a tumor activated T cell engager deal with Janux Therapeutics worth up to about $850M ($50M upfront and near term, plus up to roughly $800M in milestones and tiered royalties). Janux will take the asset through preclinical work up to the IND application, then BMS will run the human trials and commercialization, with Janux staying involved through completion of the first phase 1 study. The target is not disclosed, but BMS says it is a validated solid tumor antigen expressed across multiple cancer types. The timing is notable for Janux after a choppy stretch in late 2025 when phase 1 data for its lead program disappointed investors, and for BMS, which has been active in T cell engager partnering but has also walked away from prior initiatives.

🔹 GSK is buying RAPT Therapeutics for about $2.2B, paying $58 per share in cash in a deal expected to close in Q1 2026, and it is basically a one asset bet on making anti-immunoglobulin E (anti-IgE) therapy for food allergy far less burdensome. The prize is ozureprubart, a long acting anti-IgE monoclonal antibody in phase 2b for prophylactic protection against food allergens, aiming to rival Xolair, the first FDA approved medicine to reduce allergic reactions from accidental food exposure, but with dosing every 12 weeks instead of every two to four. Phase 2b data is expected in 2027, with phase 3 plans anticipated, and GSK gets rights outside mainland China, Macau, Taiwan, and Hong Kong.

CLINICAL TRIAL UPDATES 📊

🔹 Moderna and Merck reported long term weight behind the personalized mRNA cancer vaccine story, reporting five year follow up from KEYNOTE-942 in high risk resected stage 3 and 4 melanoma where intismeran autogene (V940, also called mRNA-4157) plus Keytruda cut the risk of recurrence or death by 49% versus Keytruda alone (HR 0.510, 95% confidence interval 0.294 to 0.887), basically matching the three year effect. Each dose is built from a patient’s tumor mutations and encodes up to 34 neoantigens to train T cells to hunt residual disease. Moderna and Merck are now trying to scale this into a post-Covid platform with eight phase 2 and phase 3 studies across tumors including non-small cell lung cancer, bladder cancer, and renal cell carcinoma, with adjuvant melanoma phase 3 fully enrolled and more analyses ahead. Wall Street is already pricing the optionality, with chatter about Keytruda-like pricing around $200k and multibillion peak melanoma sales if phase 3 holds, but the real gate is operational. Can personalized manufacturing run fast and reliably enough to fit oncology workflows?

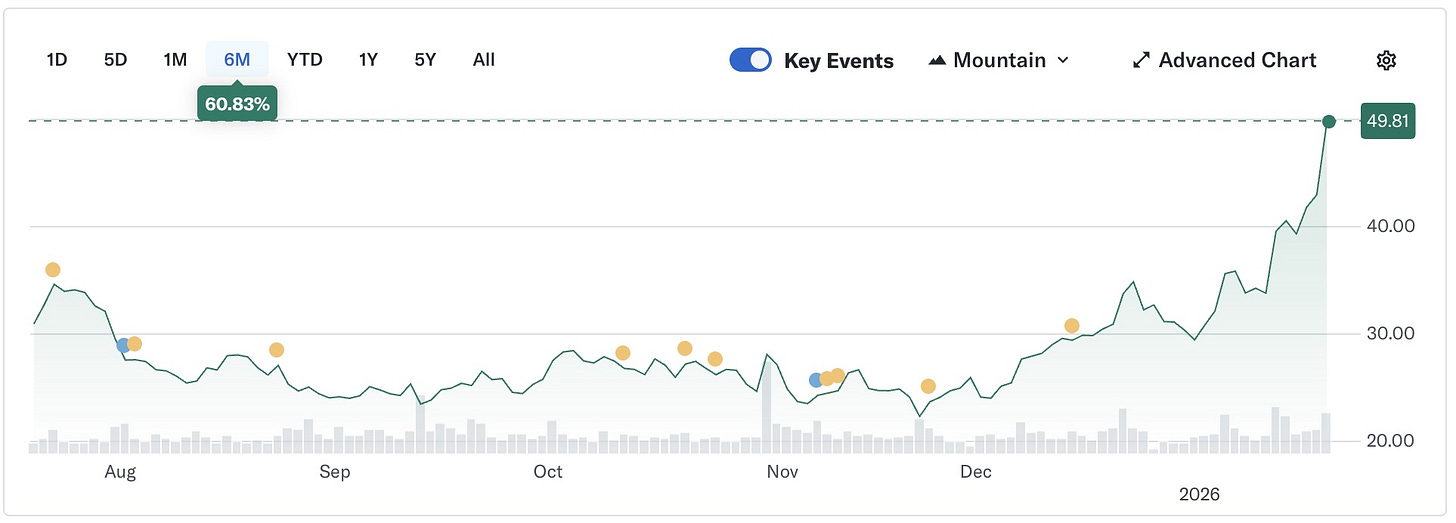

By late 2025 Moderna was the most shorted stock in the S&P 500 by percent of float, and now 2026 is starting with momentum too, with shares up about 29% over the past five sessions and printing a new 52 week high even as the CEO said Moderna will not fund new vaccine phase 3 programs for now amid US policy and regulatory pushback, instead leaning harder into cancer and heart disease.

Here is a link to last year’s deep dive on Moderna’s neoantigen vaccines:

🔹 Corcept says its phase 3 ROSELLA trial in platinum resistant ovarian cancer hit overall survival: relacorilant plus nab paclitaxel cut the risk of death by 35% versus nab paclitaxel alone (HR 0.65, p=0.0004), with median overall survival 16.0 months versus 11.9 months, a 4.1 month gain, and no meaningful increase in adverse events versus chemo alone. ROSELLA also met its other dual primary endpoint, progression free survival by blinded independent central review, with a 30% reduction in risk of progression (HR 0.70, p=0.008), and the company is leaning into a key commercial angle: no biomarker selection required. The NDA is already under FDA review with a PDUFA date of July 11, 2026, and the EMA application is also under review, setting up a high visibility mid year decision point.

🔹 Corvus dropped phase 1 Cohort 4 data for soquelitinib in moderate to severe atopic dermatitis and the numbers are punchy for an oral immunology drug in a small, placebo controlled set. In Cohort 4, patients were randomized 1:1 to soquelitinib 200 mg twice daily or placebo for 56 days. By day 56, mean EASI improvement was 72% on drug versus 40% on placebo (p=0.035), and the separation widened from day 28 to day 56. On responder endpoints, 75% of soquelitinib patients hit EASI 75, 25% hit EASI 90, and 33% reached IGA 0 or 1, versus 20%, 0%, and 0% on placebo. Corvus also pointed to real world relevance: responses looked similar in patients who had prior systemic therapy, including those described as resistant to dupilumab and JAK inhibitors, which is the population where a new oral option can realistically take share. Safety looked clean, with no new safety signals, no severe or serious adverse events, and only Grade 1 to 2 adverse events without dose interruptions. That tees up a phase 2 start in Q1 2026, expected to enroll about 200 patients.

Have a great rest of your week and thanks for reading Biotech Blueprint!

The operational question you raised about personalized manufacturing speed is really the linchpin here. Five year durability data is impressive, but if turnaround times cant match the urgency of cancer treatment timelines, all that clinical efficacy gets bottlnecked at logistics. GSK's bet on RAPT also shows how much value pharma still places on dosing convenience - every 12 weeks versus every 2-4 is a huge quality-of-life shift, even if the mechanism is proven. Clean product differentiation still commands premium multiples.