Trump’s 100% Drug Tariff and a Huntington’s Breakthrough — This Week in Biotech #71

Palsonify cleared, Evkeeza label expanded, uniQure slows HD by ~75%, Pfizer buys Metsera, Cidara accelerates flu trial, ACIP shifts COVID guidance (Sept 19-26, 2025).

Hi and welcome to This Week in Biotech by Biotech Blueprint, edition 71, covering biotech & pharma news from September 19th to 26th, 2025.

🎙️ Biotech Blueprint brings you weekly video updates on the latest biotech and pharma news, plus in-depth podcast interviews with industry leaders. You can find us on YouTube, Spotify, and Apple Podcasts.

In the latest episode, I teamed up with Hartaj from Biotech Capital Compass to kick off our mRNA therapeutics mini-series. We discussed how RNA became medicine, the engineering that enabled COVID vaccines, and what’s next.

If you missed the associated deep dive article, you can find it here:

TRENDS WE ARE FOLLOWING 📈

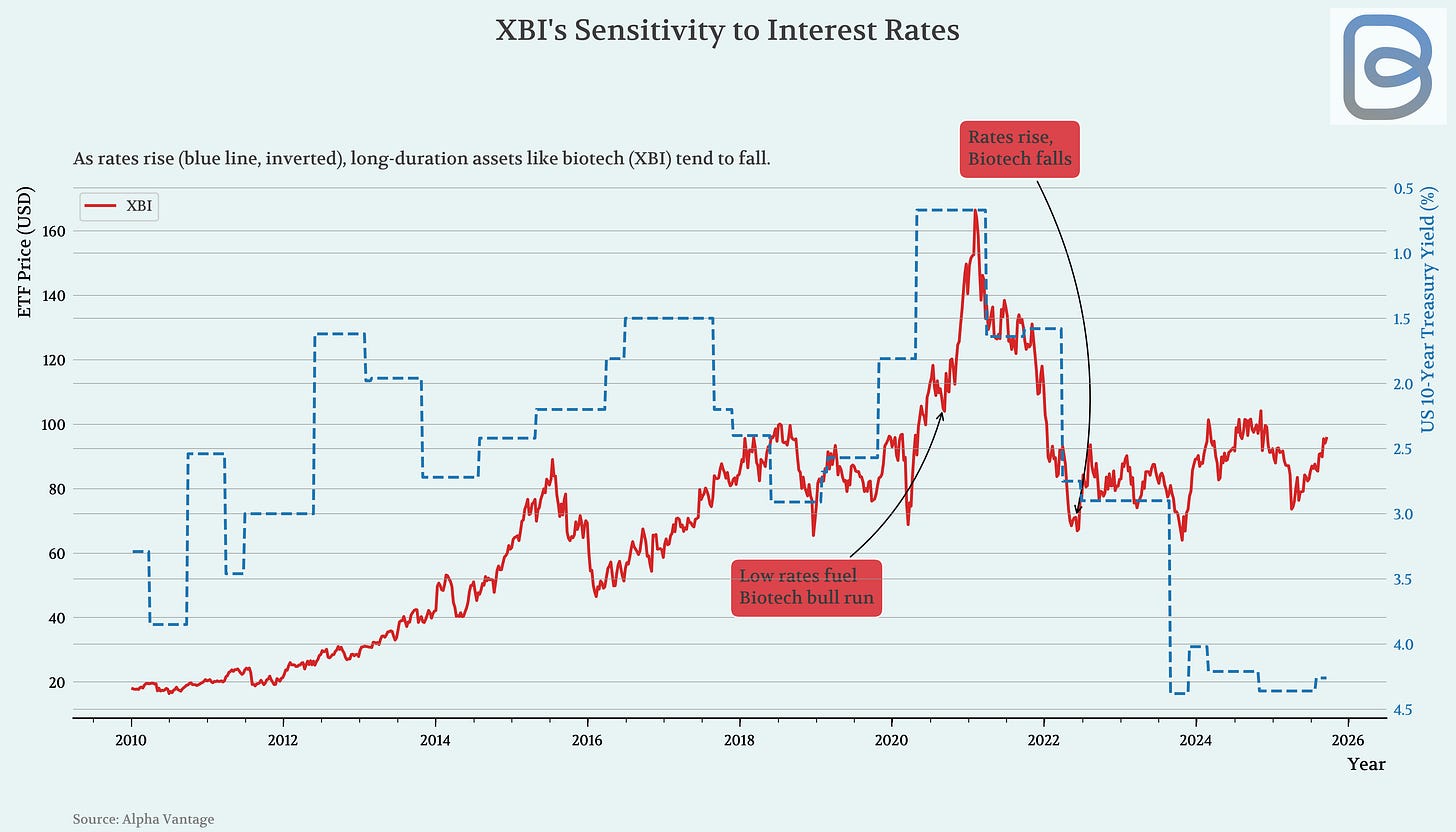

Biotech just shifted from rate headwind to tailwind: on Sept 17 the Fed cut 25 bps (now 4.0–4.25%), and our work shows why that matters more here than almost anywhere else. Historically XBI/IBB trade inversely to Treasury yields: low rates fueled the 2020–21 melt-up; the 2022 hikes lined up with the bust. With the dot plot pointing to more easing into 2026, funding conditions improve, generalists creep back into risk, and big pharma’s M&A math gets easier. In the report (co-written with my husband, a PhD economist), we share the specific thresholds on the 10-year that unlock multiple expansion, which subsectors tend to pop first, and a short list of names set up to benefit, plus one crowded theme we’re avoiding.

Full report will be available next week. If interested, please share your email address HERE so we can gauge interest.

THIS WEEK’S KEY TAKEAWAYS 🔑

No video today, but will be back with the weekly recap next week!

Here are the main updates for this week.

Tariffs: The White House landed a headline-grabbing 100% tariff on imported branded/patented drugs starting Oct 1, waived if a company has already broken ground on a U.S. plant. Generics aren’t targeted. Near-term supply disruption looks limited (Big Pharma has U.S. builds and likely stockpiles), but policy pressure to localize manufacturing just jumped.

Pfizer re-enters the obesity arms race. It’s buying Metsera (~$4.9B EV plus CVRs), picking up weekly/monthly GLP-1s, an amylin analog, and orals. The angle: monthly dosing + combo potential to differentiate in a GLP-1 market otherwise defined by weekly shots + fewer side effects.

Gene therapy’s biggest win in Huntington’s to date. uniQure’s AMT-130 (one-time, intraparenchymal AAV) slowed clinical decline ~75% at 36 months vs external controls and hit a key secondary endpoint. Small N and external comparator caveats apply, but this is the field’s first convincing disease-modifying signal.

Endocrine gets a real step forward. Crinetics’ PALSONIFY (paltusotine) won FDA approval as the first once-daily oral SST2 agonist for acromegaly, a patient-friendly shift away from burdensome depot injections. Launch in early Oct.

CMC is back in the spotlight. Complete Response Letters for Biogen’s high-dose Spinraza and Scholar Rock’s apitegromab cited manufacturing/CMC, not efficacy. Theme of the week: regulatory tolerance for CMC ambiguity is near zero, and operational execution (including third-party fill/finish) is now a core risk factor.

Flu prevention, simplified. Cidara’s CD388 got the FDA green light to run a single registrational phase 3 (starts now, includes >65), with an interim after the Northern Hemisphere season. If it works, one dose per season could be a compelling alternative for high-risk groups.

Oncology signal worth watching. Immuneering reported 86% overall survival at 9 months and 53% PFS in first-line pancreatic cancer (n=34) with atebimetinib + mGnP. It’s single-arm, small, cross-trial, but if the effect replicates in the pivotal, the MEK “deep cyclic” concept gets very interesting.

BIOTECH/PHARMA NEWS 🧬

🔹 On Friday, Trump said the U.S. will impose a 100% tariff on imported branded/patented drugs starting Oct 1. Waived if a company has already broken ground on a U.S. manufacturing plant. Generics aren’t targeted, and many big pharmas have active U.S. builds, so near-term impact may be limited (some firms likely stockpiled supply). Analysts estimate as much as $220B in pharma imports could be exposed. Markets’ reaction was mixed, with Asian pharma sliding and Europe steadier amid claims of an EU 15% tariff cap. Bottom line: policy pressure to localize manufacturing rises, but price relief for patients is unlikely and smaller manufacturers face the greatest risk.

🔹 Crinetics won FDA approval for Palsonify (paltusotine), the first once-daily oral SST2 agonist for adults with acromegaly who are not surgical candidates or had inadequate surgical response. Approval rests on PATHFNDR-1/2 phase 3 data showing rapid, durable IGF-1 control and symptom reductions with a well-tolerated profile. U.S. launch is planned for early October.

🔹 Regeneron’s Evkeeza (evinacumab) gained FDA approval for children aged 1-<5 with homozygous familial hypercholesterolemia (HoFH), extending its prior labels (≥5 years). Decision, based on compassionate-use data in six kids with no new safety issues, adds an option for about 1,300-patients in the U.S. where Evkeeza has previously cut LDL-C ~50% on top of standard therapy.

🔹 Immuneering jumped 40% and swiftly returned back to baseline on updated phase 2a data in first-line pancreatic cancer: atebimetinib (a once-daily “Deep Cyclic Inhibitor” of MEK) plus modified gemcitabine/nab-paclitaxel showed 86% overall survival at 9 months and 53% progression-free survival at 9 months in 34 patients. Historical benchmark is ~47% overall survival. Tolerability looked manageable with grade 3 neutropenia and anemia (>10%), and no new safety signals. Caveats: single arm, small sample size, and cross-trial comparisons warrant caution. The company plans to start a pivotal phase 3 by year-end 2025 (first patient mid-2026 if cleared) and aims to add atebimetinib combos in other tumors (e.g., NSCLC) in 2026.

🔹 Cidara Therapeutics fast-tracked its registrational plan for CD388, a single subcutaneous dose preventive for seasonal flu. After an End-of-phase 2 meeting, FDA feedback allows a single phase 3 trial that could support BLA approval, with enrollment starting by end-Sept 2025 (six months earlier) across the Northern Hemisphere and continuing into Spring 2026 in the Southern Hemisphere. The study widens to include adults >65 (in addition to high-risk or immunocompromised ≥12), doubling the potential U.S. addressable population from ~50M to >100M. Target enrollment is 6k with an interim read after the NH flu season. Shares rose 15% on the update. Management says financing secured earlier this summer should fund phase 3 through completion. Guggenheim lifted its price target to $167, calling FDA feedback strong validation.

🔹 The FDA issued CRLs for Biogen’s higher-dose Spinraza and Scholar Rock’s apitegromab, citing manufacturing/CMC issues (no efficacy/safety concerns). Biogen’s sNDA needs CMC updates and will be promptly resubmitted. The high-dose regimen is already approved in Japan and under EMA review. Scholar Rock’s rejection stems from issues at Novo Nordisk’s (ex-Catalent) Bloomington fill-finish site. The company will resubmit after remediation, with EU review ongoing (decision ~mid-2026). Analysts see minimal impact on ultimate approval odds.

🔹 Moderna said its updated 2025-26 COVID-19 vaccine mNEXSPIKE generated a strong immune response against the LP.8.1 variant, boosting neutralizing antibodies >16-fold on average in adults ≥65 and in ages 12-64 at higher risk. Safety looked consistent with prior studies. The readout follows earlier data showing Spikevax (the other Moderna shot for this season) drove >8-fold LP.8.1 antibody rises in the same groups. Both vaccines are already FDA-cleared for seniors and higher-risk individuals, and Moderna frames the results as confirming the preclinical data underpinning those approvals.

🔹 Pfizer agreed to acquire Metsera to reboot its obesity strategy, paying $47.50 per share in cash (~$4.9B enterprise value) plus up to $22.50 per share in contingent value rights tied to phase 3 start and potential FDA approvals for monthly GLP-1 and GLP-1+amylin combo programs. Metsera brings a next-gen obesity/cardiometabolic portfolio: MET-097i (weekly and monthly injectable GLP-1 in phase 2), MET-233i (monthly amylin analog in phase 1, alone and with MET-097i), two oral GLP-1 candidates nearing first-in-human studies, and additional preclinical hormone therapeutics. Pfizer says monthly dosing, early efficacy/tolerability signals, and combo potential could be “best-in-class,” with its scale to accelerate development and manufacturing. The all-cash deal, unanimously approved by both boards, is expected to close in Q4 2025.

🔹 U.S. officials are weighing a federally backed website, potentially branded “TrumpRx,”that would let patients search for prescription drugs and connect directly to company platforms offering discounted prices, per Bloomberg. HHS referred questions to the White House. CMS and the White House haven’t commented.

🔹 Last Friday, the CDC’s ACIP voted 12-0 to make COVID-19 vaccination “shared clinical decision-making” for everyone ≥6 months (benefit strongest in ≥65 and high-risk under-65s). A prescription requirement failed (6-6). The panel instead encouraged a brief clinician conversation, with the acting CDC director to finalize. Separately, ACIP backed universal hepatitis B testing in pregnancy and VFC coverage for giving MMR and varicella as separate shots in toddlers (slightly lower febrile-seizure risk vs MMRV).

CLINICAL TRIAL UPDATES 📊

🔹 uniQure’s AMT-130 hits in Huntington’s disease (first disease-modifying signal): In a pivotal phase 1/2, the high dose of AMT-130 (one-time AAV gene therapy delivered via brain surgery) slowed clinical decline ~75% at 36 months on cUHDRS vs a propensity-matched natural-history control, and also met a key secondary endpoint. CSF neurofilament light trended below baseline at 36 months. Safety was manageable with no new drug-related SAEs since 2022. BLA planned Q1’26 with a potential U.S. launch later that year if approved. Caveats: small N (29 total; 17 high-dose), external control (not randomized head-to-head), invasive delivery, and likely high cost, but this is the most compelling disease-modifying HD result to date.

🔹 Acadia fails phase 3 in Prader-Willi and dropped the program. Acadia’s intranasal carbetocin (ACP-101) missed the primary endpoint (HQ-CT change at week 12) and showed no separation on secondary endpoints in the 175-patient COMPASS PWS trial; safety was consistent with prior studies. The company will discontinue development and share a data summary later. Shares fell 11-13% premarket, while rival Soleno rose 14% as its approved Vykat XR remains the only U.S. therapy targeting PWS hyperphagia.

🔹 Ionis reported positive pivotal results for zilganersen, an antisense drug for Alexander disease, a rare, progressive, often fatal astrocyte disorder with no approved disease-modifying therapies. In a 54-patient global phase 1-3 study, the 50 mg cohort met the primary endpoint at week 61, showing clinically meaningful stabilization of gait speed on the 10-Meter Walk Test vs. control (mean difference 33.3%, p=0.04). Safety was favorable, with mostly mild/moderate AEs and fewer serious AEs than control. Ionis plans an NDA filing in Q1 2026 and is evaluating a potential Expanded Access Program in the U.S.

Have a great rest of your week and thanks for reading Biotech Blueprint!

👩🏻💻 BIOTECH BLUEPRINT CONSULTING

We provide tailored consulting solutions designed to meet the unique challenges of both established companies and startups. The services span a wide range of strategic and technical needs, including AI automation tools.

BOOK A FREE 30-MINUTE CONSULTATION OR A MEET & GREET below.

DISCLAIMER: This content is for informational purposes only. It should not be taken as legal, tax, investment, financial, or other advice. The views expressed here are my own and do not reflect the opinions of any company or institution.

DISCLOSURE: I have no business relationships with any company mentioned in this article.

Excellent weekly roundup as always. The Acadia failure in COMPASS PWS is a huge validation moment for Soleno's VYKAT XR - the 14% share price pop makes sense given that intranasal carbetocin was probably the nearest competitive threat. The fact that ACP-101 missed on both primary and secondary endpoints suggests the oxytocin pathway approach just doesn't work as well for PWS hyperphagia compared to DCCR's KATP channel mechanism. With Acadia discontinuing development entirely, Soleno now has a clear runway as the only FDA-approved therapy for PWS hyperphagia. Do you think this strengthens Soleno's positioning for potential M&A, or will they try to build out a commercial franchise independently? The competitive moat just got a lot wider. Also apprecate the uniQure HD data summary - that 75% slowing of clinical decline is impressive even with the small N caveat.