FDA Tightens Vaccine Pathways, Medicare Slashes Drug Prices — This Week in Biotech #80

Plus Duchenne’s landmark phase 3 win, a survival boost in glioblastoma, motion sickness momentum at Vanda, and ACIP’s newborn vaccine chaos (Nov 21-Dec 4, 2025).

Hi and welcome to This Week in Biotech by Biotech Blueprint, edition 80, covering biotech & pharma news from November 21st to December 4th, 2025.

📣 With the holidays approaching, This Week in Biotech will skip Dec 26 edition. Our final issue of the year drops Dec 19, covering the biggest biotech developments of 2025, and we’ll be back Jan 2, 2026 with themes and companies to watch next year.

🌐 Visit our updated website, biotechblueprintconsulting.com, where we’re posting new visuals, reports, and details on our consulting work.

🎙️ Biotech Blueprint brings you weekly video updates on the latest biotech and pharma news, plus in-depth podcast interviews with industry leaders. You can find us on YouTube, Spotify, and Apple Podcasts.

In the latest episode, I sat down with Sensible Biotechnologies’ CEO and principal computational scientist to talk their cell-based mRNA platform and where mRNA goes next.

🔜 Coming up next week on Biotech Blueprint is a founder who built and sold one biotech to AbbVie and is now taking another into Phase 3. I’ll be sitting down with Dr. Josep Bassaganya-Riera, CEO of NImmune Biopharma, to talk about gut-restricted, tolerance-restoring oral therapies in inflammatory bowel disease, how LANCL2/Treg biology could reshape the treatment sequence, and how AI is actually influencing development decisions inside NImmune rather than just decorating slide decks.

THIS WEEK IN BIOTECH VIDEO SUMMARY

THIS WEEK’S KEY TAKEAWAYS 🔑

Regulatory shifts continued this week, starting with new leadership at CDER, where Tracy Beth Høeg stepped in as acting director following Richard Pazdur’s abrupt exit. Separately, FDA vaccine policy tightened as CBER head Vinay Prasad pushed for randomized trials for seasonal flu shots, a bar experts say is operationally impossible. Taken together, the moves signal an agency increasingly inclined toward skeptical and verification heavy decision making. Former FDA commissioners warned the new posture could slow innovation.

Pricing reform also came into sharper focus with CMS releasing its 2027 Medicare “maximum fair prices.” The headline cut was to semaglutide (Ozempic, Wegovy, and Rybelsus will drop 71% to $274 per month) reshaping long term revenue expectations for obesity drugs. Several other widely used medicines also saw steep negotiated reductions. Federal involvement in drug pricing now looks less like a one time exercise and more like a long term feature.

On the clinical side, two programs delivered unusually meaningful progress. Capricor’s phase 3 HOPE-3 data in Duchenne muscular dystrophy showed both skeletal and cardiac benefits in a mostly nonambulatory population, which is an area where trials have repeatedly failed. A 54% slowing of upper limb decline and a 91% slowing of cardiac deterioration suggest deramiocel could carve out a first-in-class position targeting Duchenne cardiomyopathy. In glioblastoma, Imvax reported a 6.3-month improvement in median overall survival, suggesting an encouraging signal in a tumor type that has resisted progress for two decades.

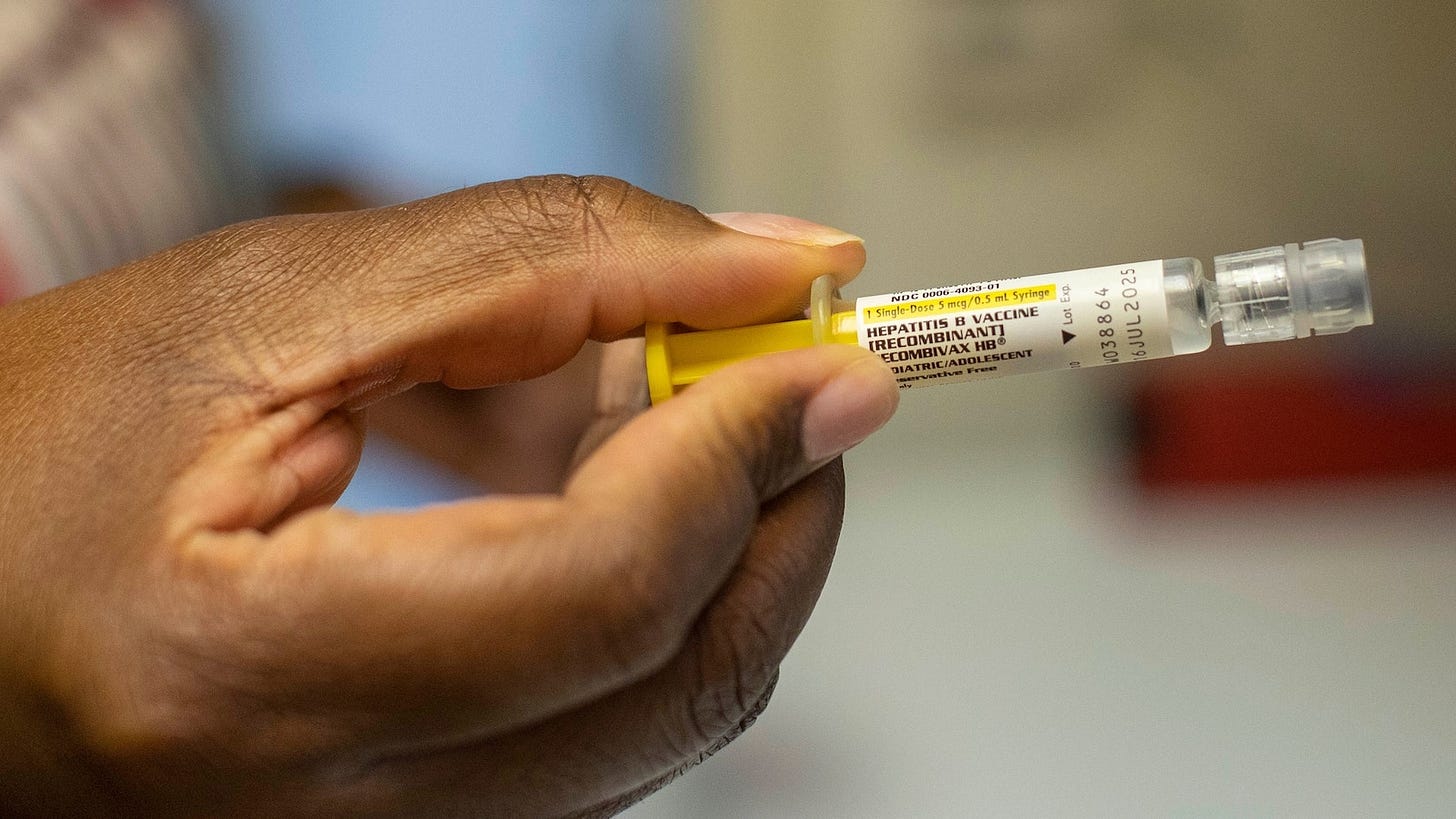

Public health developments were mixed. ACIP again postponed its vote on changing the newborn hepatitis B recommendation after confusion over the wording of its own proposals, adding to the growing sense of procedural uncertainty at the committee. The meeting starts today (12/5) at 8 am EST. Meanwhile, Kentucky confirmed a third infant whooping cough death, and Washington state reported the first human case of H5N5 worldwide. Both isolated events, but reminders that gaps in vaccination and viral evolution continue to challenge the system.

BIOTECH/PHARMA NEWS 🧬

🔹 FDA enters a new, more combative regulatory era: Following Richard Pazdur’s abrupt exit, Commissioner Marty Makary quickly appointed Tracy Beth Høeg, an epidemiologist critical of COVID-era mandates, as Acting CDER Director, while Vinay Prasad at CBER decided to require randomized trials even for seasonal flu vaccines. Together, the new leadership is signaling a break from decades of consensus-driven regulation toward a far more skeptical, adversarial model. Former FDA commissioners warned in NEJM that these changes could “suppress innovation” and price smaller companies out of vaccines entirely. Markets agreed: diversified pharmas shrugged (Pfizer, Merck), while Moderna and Vaxcyte fell 6-7% as investors recalibrated the risk that vaccine approvals could slow to a crawl under the new rules.

🔹 CMS released its 2027 Medicare “maximum fair prices,” headlined by a 71% cut to semaglutide. Ozempic, Wegovy, and Rybelsus will drop from $959 to $274/month, a major hit to Novo Nordisk’s Medicare revenue base. Merck’s Janumet saw the steepest cut (–85%, now $80), with other high-spend drugs also sharply repriced: GSK’s Trelegy (–73%), AbbVie’s Linzess (–75%), BMS’s Pomalyst (–60%), Pfizer’s Ibrance (–50%), and AstraZeneca’s Calquence (–40%). Fifteen drugs in total will carry negotiated IRA prices starting in 2027. The biggest strategic shock is the semaglutide reset. Washington has now directly stepped into the GLP-1 pricing arena, forcing a rethink of long-term revenue curves for obesity’s future $100B market.

🔹 Vanda got a clean regulatory win as the FDA lifted its partial clinical hold on tradipitant for motion sickness, agreeing it’s an acute, event driven use case that doesn’t require long term toxicity studies. This frees Vanda to run fuller trials without the 90 dose cap. Separately, the NDA for tradipitant in motion induced vomiting stays on track with a Dec. 30 PDUFA, positioning the drug to become the first new pharmacologic option for motion sickness in 40 years.

CLINICAL TRIAL UPDATES 📊

🔹 Janux (JANX007) prostate cancer data: Updated phase 1 results showed a 30% objective response rate, which is a solid, but down from the eye-catching 50% response that fueled last year’s rally. The mechanistic story remains compelling: durable 8 month rPFS, strong PSA reductions, and a safety profile that avoids the cytokine storm problem typical of T-cell engagers. But markets punished the “optical downgrade” and the fact that several responses remain unconfirmed. Still, the every-two-week dosing shift and cleaner tolerability reinforce that the drug is active — just not the hype-cycle miracle investors priced in.

🔹 Capricor’s pivotal phase 3 HOPE-3 trial hit both its primary skeletal muscle endpoint and key cardiac endpoint in Duchenne muscular dystrophy, showing a 54% slowing of upper limb decline and 91% slowing of decline in left ventricular ejection fraction, both statistically significant. All controlled secondary endpoints also met, with a clean safety profile in a largely nonambulatory population where past studies have routinely failed. The data position deramiocel as a potential first in class therapy for Duchenne cardiomyopathy, directly addressing the leading cause of death in DMD. Capricor plans to resubmit its BLA after July’s CRL, and the stock jumped over 400% as investors reassessed regulatory odds and commercial potential.

🔹 Imvax reported positive topline phase 2b data for IGV-001 in newly diagnosed glioblastoma, showing a 6.3-month (45%) improvement in median overall survival vs. standard of care (20.3 vs. 14.0 months) in a 99 patient randomized, placebo controlled study. While the trial missed its primary endpoint of progression-free survival, the survival lift (rare in GBM, where outcomes haven’t meaningfully improved in more than 20 years) is drawing attention. Safety looked clean with no drug-related serious adverse events, reinforcing IGV-001’s benign tolerability profile. Imvax will now take the data to the FDA.

🔹 Protara (TARA-002) in non-muscle invasive bladder cancer (NMIBC): Phase 2 data delivered a 72% complete response rate at any time point in BCG-naïve patients, settling at 50% at 12 months - competitive durability in a high-need setting. The bigger win is regulatory: FDA agreed future registrational trials won’t require a BCG comparator, a major concession amid national BCG shortages. With no Grade ≥3 adverse events and a profile suited for real-world adoption, TARA-002 is now positioned as a credible “plug-and-play” option, provided upcoming 2026 data in the tougher BCG-unresponsive population confirm the signal.

PUBLIC HEALTH CORNER

🔹 ACIP’s hepatitis B vote devolves into procedural chaos: The committee again postponed its decision on delaying the newborn hepatitis B vaccine, this time because voting questions were rewritten three times in 72 hours, leaving members unsure what they were even being asked to decide. The current draft leans toward “shared decision-making” for infants of mothers who test negative, with immediate vaccination for infants of mothers who are positive or unknown status, plus a proposal for insurer-covered serology before later doses. Despite a 99% drop in pediatric hepatitis B since 1991, ACIP’s drift toward optionality risks splintering national practice: the American Academy of Pediatrics will keep the universal birth dose, but hospitals and insurers could diverge.

🔹 Whooping cough death in Kentucky marks a widening resurgence: A third infant fatality underscores that pertussis is no longer a blip but a returning endemic threat. U.S. cases topped 25k in 2025 (the highest in over a decade) driven largely by slipping kindergarten vaccination rates (now 92.1% vs. 95% pre-pandemic). The pathogen is exploiting immunity gaps, especially in undervaccinated clusters, keeping circulation above historical baselines.

🔹 First human case of H5N5 avian flu detected: An elderly Washington resident with exposure to backyard poultry has died from H5N5, the first documented human infection with this strain. There is no evidence of human-to-human spread, but the shift from H5N1 to H5N5 signals viral diversification in wild bird reservoirs. Officials are urging flu vaccination to reduce the risk of coinfection-driven reassortment events, the mechanism behind jumps of pandemic scale.

Have a great rest of your week and thanks for reading Biotech Blueprint!

That semaglutide price drop is brutal for Novo's revenue model but honestly feels like the opening act. If CMS can cut a blockbuster GLP-1 by 70%, it signals they're done being polite about high-spend drugs. On the regulatory side, Høeg and Prasad demanding RCTs for seasonal flu vaccines is technically rigorous but operationally impossible, which probably is the point. Slowing down approvals by raising the bar too high might look like good science policy until you realize it just pushes smaller players out.

Exceptional roundup capturing the regulatory pivot at FDA and CMS simultaneously rewriting the pricing playbook. The Capricor DMD data showing cardiac benefits alognside skeletal is the kind of dual endpoint win that actually chnages treatment paradigms, not just adds incremental value. What strikes me is how the semaglutide price cut to $274 fundamentaly shifts obesity economics while FDA's new vaccine stance could paradoxically slow innovation.