CDC Vaccine Schedule Shifts, Practice-Changing Phase 3 Wins, and Deal Heat – This Week in Biotech #84

Revolution takeover rumors, Amgen and Lilly pay early for platforms, plus phase 3 wins in gastroesophageal cancer, psoriasis, and hepatitis B amid a CDC vaccine schedule shift (Jan 2-8, 2026)

Welcome back to This Week in Biotech by Biotech Blueprint, edition 84, covering biotech and pharma news from January 2nd to 8th, 2026.

🎙️ Biotech Blueprint brings you weekly video updates on the latest biotech and pharma news, plus in-depth podcast interviews with industry leaders. You can find us on YouTube, Spotify, and Apple Podcasts.

SPONSOR CONTENT BY ARCHES DATA

We help biotech CEOs and leadership teams pressure test strategy through rigorous data science, forecasting, and scenario analysis. From deep dive custom research to complex market modeling, we provide the evidence you need to lead with confidence.

Book a consultation HERE.

Visit our website: archesdata.com.

VIDEO SUMMARY

THIS WEEK’S KEY TAKEAWAYS 🔑

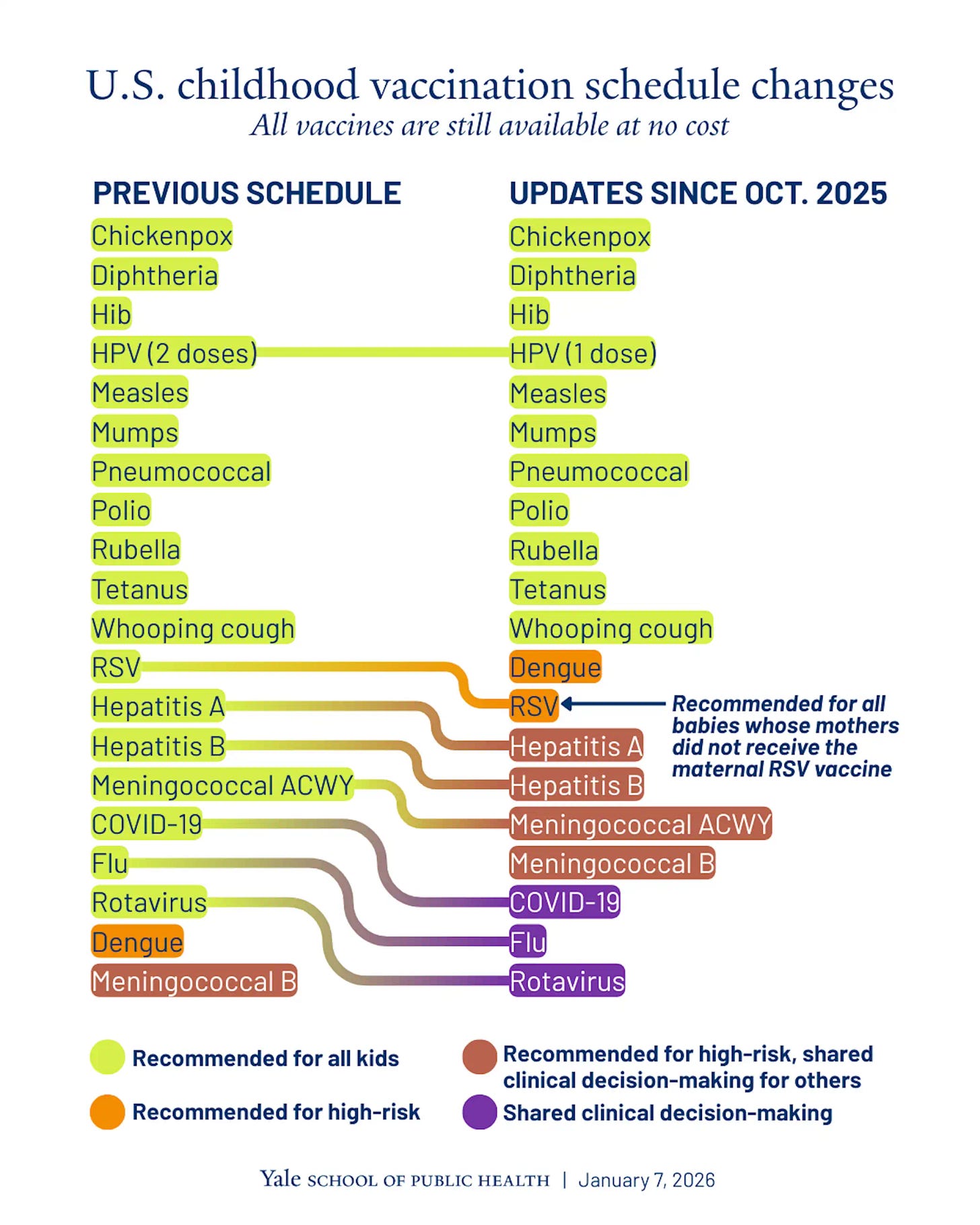

On Monday (Jan 5th) HHS said the CDC is reshaping the childhood immunization schedule, shifting several familiar vaccines out of “recommended for all” and into “high risk” or “shared decision making.” Even if insurance still covers everything, the behavioral effect is the point. More friction means fewer routine shots, more confusion for parents, and a higher chance of outbreaks. For vaccine makers and anyone building around prevention, this injects demand uncertainty straight into strategy.

On the data front, two readouts stood out because they can change standards of care. Jazz’s Ziihera delivered phase 3 first line results in HER2-positive gastroesophageal adenocarcinoma that beat trastuzumab plus chemotherapy on time before progression. The arm that added tislelizumab reached a median overall survival of 26.4 months. In immune disease, Alumis reported phase 3 plaque psoriasis results for envudeucitinib, an oral inhibitor of tyrosine kinase two, with unusually high rates of near complete and complete skin clearance by six months. The market cared because it is an oral drug posting efficacy that starts to resemble injectable biologics.

Chronic hepatitis B also got a meaningful catalyst. GSK and Ionis reported positive phase 3 topline results for bepirovirsen, showing a statistically significant lift in “functional cure” when added to standard nucleoside therapy. Translation: today’s care often means long term suppression with low cure rates. A finite course that can produce sustained loss of surface antigen and undetectable viral DNA would be a genuine shift, and GSK is already pointing to regulatory filings starting in the first quarter of 2026.

Mergers took center stage this week. Revolution Medicines became the takeover rumor of the week, with the narrative shifting from AbbVie to Merck and a floated $28 to $32 billion range, though nothing is signed and neither company is confirming. Separately, Amgen’s up to $840 million buyout of preclinical Dark Blue Therapeutics and Lilly’s up to $950 million collaboration with InduPro both signal the same thing: big pharma is still willing to pay early for differentiated mechanisms and enabling platforms, then scale them internally.

BIOTECH/PHARMA NEWS 🧬

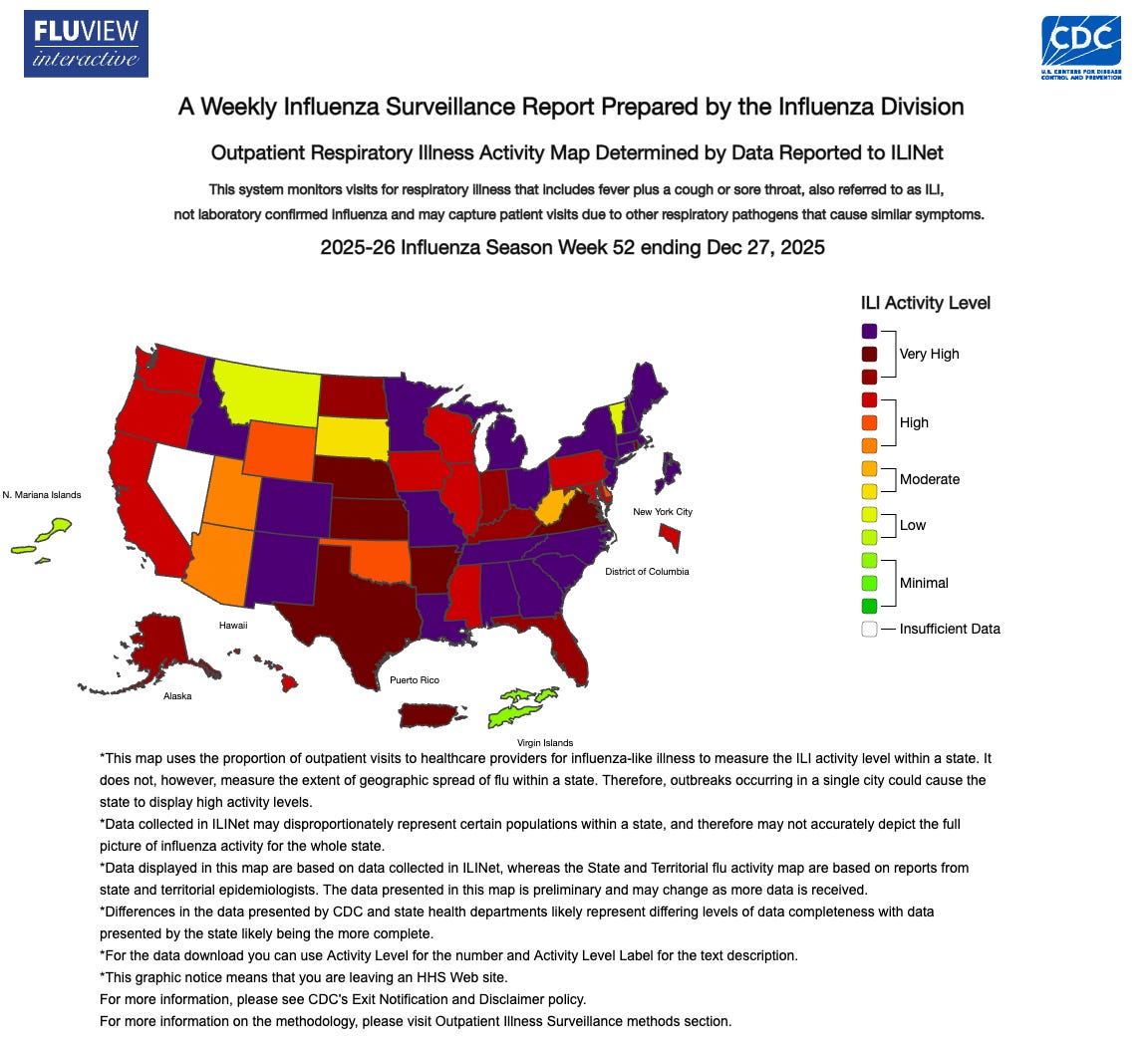

🔹 Generic oseltamivir (Tamiflu) is showing regional stockouts, with ASHP flagging demand-driven supply strain and some sites already shifting to conservation or substitution. At the same time, CDC’s outpatient flu-like illness indicator hit 8.2% for the week ending Dec 27, 2025, a level CDC notes is the highest for that metric in decades, with flu A(H3N2) viruses predominant. The practical point is that antivirals are most valuable when started early, especially for hospitalized and high risk patients, so shortages tend to push clinicians toward alternatives (baloxavir, zanamivir, IV peramivir) rather than change the overall clinical playbook.

🔹 Vanda said the FDA rejected its attempt to expand Hetlioz (tasimelteon) into jet lag disorder, sending the stock down about 11% premarket. The agency told Vanda its sNDA could not be approved in its current form because the evidence did not adequately show effectiveness for real world jet lag. FDA’s core issue was that Vanda’s main studies used controlled phase-advance sleep shifts (5h and 8h bedtime changes), which the FDA argued are not close enough to actual jet travel conditions. Vanda disagrees, arguing those models are a standard surrogate for circadian misalignment and that its package includes supportive evidence including simulated and transatlantic travel outcomes. This re-review followed a court ordered reset of a prior refusal and an October 2025 framework agreement for an expedited decision.

🔹 Eli Lilly struck a discovery and licensing collaboration with InduPro Therapeutics worth up to $950M plus an undisclosed equity investment, betting that “spatial biology” can help it build more tumor selective multispecific cancer drugs. InduPro will run early discovery on up to three undisclosed targets using its AI and machine learning-enabled membrane interactomics platform, which maps which surface proteins sit close together on tumor cells, then proposes co-target pairs meant to improve the safety and potency of bispecific antibody drug conjugates and multispecific T cell engagers. The timing matters: InduPro only formed in 2022, raised an $85M Series A in mid 2024, and just announced a separate Sanofi partnership and equity check last month, so this is another fast vote of confidence from big pharma in a platform that is still preclinical.

🔹 Revolution Medicines jumped on a Wall Street Journal report that AbbVie was in advanced talks to buy the company, then AbbVie told Reuters it was not in discussions and the premium faded. Now the reporting points to Merck instead with a rumored $28B to $32B price range, though nothing is signed and Revolution is not commenting.

🔹 The Department of HHS says the CDC, led by Acting Director Jim O’Neill, is immediately reshaping the U.S. childhood immunization schedule after a Trump-ordered peer-country review: a smaller set stays “recommended for all” (including measles, mumps, rubella, polio, pertussis, tetanus, diphtheria, Haemophilus influenzae type b, pneumococcal disease, varicella, and human papillomavirus), while several familiar shots like influenza, COVID-19, rotavirus, hepatitis A, hepatitis B, RSV, and meningococcal disease shift to “high-risk” or “shared clinical decision-making” (doctor/parent consult). Officials stress insurance will still cover everything with no cost-sharing, but pediatric and public health experts argue the real effect is behavioral: fewer automatic reminders, less routine stocking, more parental confusion, and higher odds of preventable outbreaks plus a messy state-by-state patchwork as school requirements diverge.

🔹 Amgen agreed to acquire U.K.-based Dark Blue Therapeutics for up to $840M, pulling an Oxford-linked, preclinical oncology program into its own research organization. The key asset, DBT-3757, is a small molecule targeted protein degrader aimed at MLLT1 and MLLT3 (proteins implicated in certain subsets of acute myeloid leukemia) with early data in leukemia models suggesting a differentiated mechanism and potential for both single agent and combination use. The broader read is that Amgen is still willing to buy mechanism-led science before the clinical price tag kicks in, especially in hard diseases where new biology can matter.

CLINICAL TRIAL UPDATES 📊

🔹 Alumis said its next gen oral TYK2 inhibitor envudeucitinib delivered strong phase 3 results in moderate to severe plaque psoriasis. At 16 weeks, about 3/4 patients achieved at least a 75% improvement in skin severity and area (PASI 75), and about 3/5 were rated clear or almost clear by investigators (sPGA 0/1), both versus placebo. By 24 weeks, roughly 2/3 reached near complete clearance (PASI 90) and more than 2/5 had completely clear skin (PASI 100) on average across the two trials, and the drug beat apremilast on every psoriasis clearance benchmark at Week 24. Safety looked consistent with earlier studies and no new safety signals were flagged; Alumis says it plans to file for FDA approval in the second half of 2026.

🔹 GSK and Ionis reported positive topline phase 3 results for bepirovirsen in chronic hepatitis B, with both B-Well 1 and B-Well 2 meeting the primary endpoint and showing a statistically significant, clinically meaningful increase in “functional cure” when bepirovirsen was added to standard nucleos(t)ide analogue therapy versus standard therapy alone. Functional cure here means sustained loss of hepatitis B surface antigen and undetectable hepatitis B virus DNA for at least 24 weeks after finishing a finite treatment course, a big deal in a disease where current cures are rare and many patients stay on lifelong suppression. The trials enrolled more than 1,800 patients across 29 countries, showed a safety and tolerability profile consistent with prior studies, and looked even stronger in patients starting with lower hepatitis B surface antigen levels. GSK plans global regulatory filings starting in the first quarter of 2026, and if approved this could become a first finite six month backbone therapy for chronic hepatitis B, with real downstream implications for liver cancer risk.

🔹 Immuneering sold off even as it posted what look like strong phase 2a signals for atebimetinib plus modified gemcitabine and nab paclitaxel in first line pancreatic cancer. The company reported 64% overall survival at 12 months versus a 35% benchmark from historical standard of care data, along with a 39% overall response rate and 8.5 month median progression free survival versus 5.5 months, and it highlighted a tolerability profile where only neutropenia and anemia crossed the 10% threshold for grade 3 events. The market reaction looks like relative competition math, since investors are comparing cross trial headlines to other first line contenders like Verastem’s avutometinib + defactinib and Revolution Medicines’ daraxonarasib, even though follow up times and trial designs differ and Immuneering itself flags there is no head to head comparison. Next catalyst is whether this survival separation holds as the cohort expands beyond 50 patients and as the company moves toward its planned phase 3 start in mid 2026.

🔹 Jazz said its bispecific HER2 antibody Ziihera (zanidatamab) just delivered “practice-changing” phase 3 first line data in HER2-positive locally advanced or metastatic gastroesophageal adenocarcinoma, beating the long-standing Herceptin (trastuzumab) plus chemotherapy control. Both Ziihera + chemo and Ziihera + Tevimbra + chemo cut the risk of progression or death by about 35% and pushed median progression-free survival to 12.4 months versus 8.1 months. The median overall survival reached 26.4 months with the Ziihera + Tevimbra regimen (24.4 months for Ziihera + chemo). Diarrhea was the main tradeoff (higher grade ≥3 rates but few discontinuations). If these numbers hold up through regulatory review, this looks like the long-awaited HER2 upgrade in upper gastrointestinal cancer.

Have a great rest of your week and thanks for reading Biotech Blueprint!